There are too many risks in L/C, how to prevent them?

Sunny Worldwide Logistics is a logistics company with more than 20 years of transportation experience, specializing in Europe, America and Canada, Australia, Southeast Asia and other markets, more than the owner of the owner~!

Letter of credit, as a relatively more secure and bank credit-based trade settlement tools, widely used in international trade, occupies a very important position, and can even be said to be the most commonly used payment method of international trade payment method.

Products are almost the same, the price is almost the same, others can accept LC, do you accept?

Small single Paypal, single TT, large single customers want to use TT + LC, do you accept?

Short-term 100% TT, medium-term TT + DP, long-term customers want LC, do you accept?

It is no exaggeration to say that every person doing foreign trade will come into contact with it sooner or later. For every exporter, the bigger the business gets, the more inclusive the payment method becomes.

Therefore, L/C payment is also the trend in international trade!

Most people who have not been in contact with the L / C to listen to the complexity, the first contact is a variety of issues come and go, disorganized, clueless. The following small editor for you to organize the L / C payment methods for your reference.

Specifically and systematically understand the letter of credit payment method

1、What is a letter of credit?

2、Why is there a letter of credit?

3、What is included in the letter of credit?

4、How does letter of credit work?

How to define the letter of credit payment method

Letter of Credit (Letter of Credit, L/C) refers to a written document in which payment is made by a bank (issuing bank) to a third party (beneficiary) or its designated party in accordance with (applicant's) requirements and instructions or on its own initiative, in compliance with the terms of the letter of credit, and on the basis of the specified documents. That is, the letter of credit is a kind of bank issued a conditional commitment to pay the written documents.

Why is there a letter of credit payment method

In international trade activities, buyers and sellers may not trust each other, the buyer is concerned about the prepayment, the seller does not ship the goods according to the contract requirements; the seller is also worried about the shipment or submission of shipping documents after the buyer does not pay. Therefore, the need for two banks as the buyer and seller as a guarantor, on behalf of the collection and delivery of the bill, to bank credit instead of commercial credit. Banks in this activity is the tool used in the letter of credit.

So the letter of credit payment is with the development of international trade, banks involved in the process of international trade settlement gradually formed. As the payment of goods to obtain in line with the provisions of the letter of credit as a condition of freight documents, to avoid the risk of prepayment of goods, so the letter of credit payment method to a large extent to solve the import and export parties in the payment and delivery of the problem of conflict. It has become a major payment method in international trade.

Letter of credit include what content

(1) the description of the letter of credit itself. Such as its type, nature, validity and expiration date.

(2) Requirements for the goods. Description according to the contract.

(3) Requirements for transportation.

(4) Requirements for documents, i.e. goods documents, transportation documents, insurance documents and other relevant documents.

(5) Special requirements.

(6) The issuing bank of the beneficiary and the bill of exchange holder to ensure the responsibility of payment of the text.

(7) most of the foreign evidence are annotated: "In addition to other provisions, this certificate in accordance with the International Chamber of Commerce "Uniform Customs and Practice for Documentary Credits" that is, the International Chamber of Commerce Publication No. 600 ("ucp600") for processing."

(8) inter-bank wire transfer claims clause (t/t reimbursement clause).

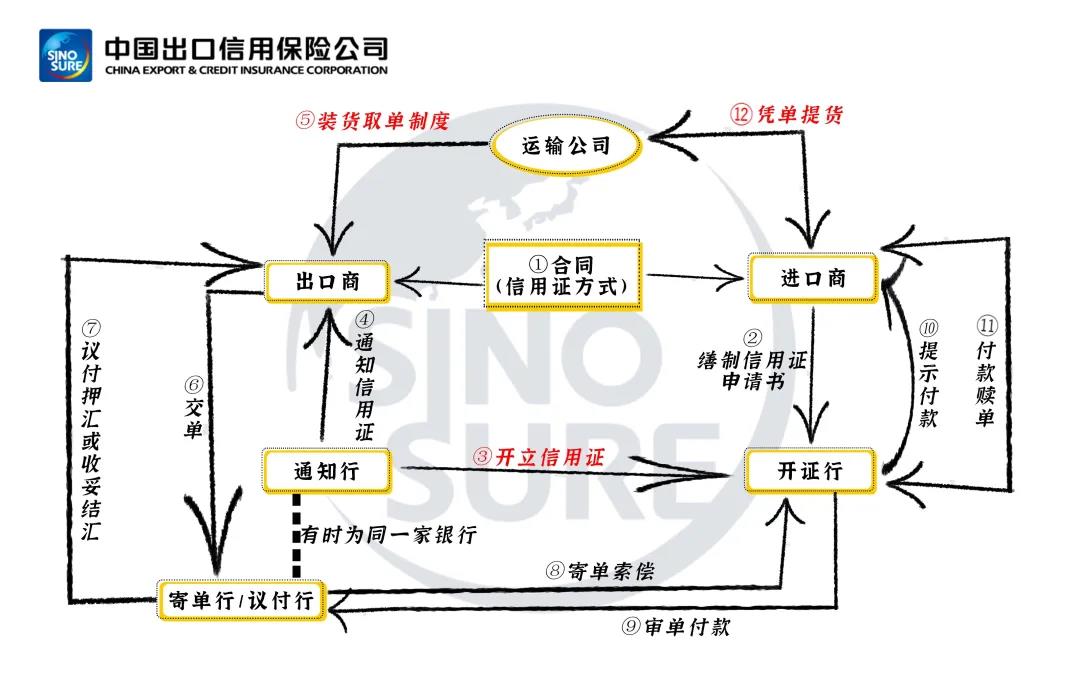

How the letter of credit works

(1) The applicant for the issuance of a letter of credit according to the contract to fill out an application for the issuance of a letter of credit and deposit or provide other assurances, and ask the issuing bank to open a letter of credit.

(2) The issuing bank issues a letter of credit to the beneficiary according to the application and sends it to the notifying bank where the exporter is located.

(3) The notifying bank will hand over the letter of credit to the beneficiary after checking the seal for accuracy.

(4) After reviewing the content of the letter of credit and the contract, the beneficiary shall ship the goods, prepare the documents and issue a bill of exchange according to the provisions of the letter of credit and send it to the negotiating bank for negotiation and payment within the validity period of the letter of credit.

(5) The negotiating bank will advance the payment to the beneficiary after reviewing the documents according to the terms of the letter of credit.

(6) The negotiating bank will send the bill of exchange and shipping documents to the issuing bank or its specific payment bank to claim.

(7) The issuing bank to check the documents are correct, payment to the negotiating bank.

(8) The issuing bank notifies the issuer to pay for the redemption.

Frequently asked questions when choosing L/C payment method

1、How should L/C be applied under FOB conditions?

2、When should the different issuance dates under L/C be counted?

3、Double expiration of the L/C, early shipment delivery period how?

L/C in the FOB terms of application

L/C in FOB conditions, the bill of lading in the freight terms: freight payable as per charter party can be indicated? Why?

This L/C FOB conditions, refers to the bulk cargo chartering rather than go container container, generally by the buyer chartering, the buyer and the shipping company will have a CHARTER PARTY charter contract. For this kind of bulk bill of lading, letter of credit even if there is no regulation, but if it is to the letter of credit settlement, the bank will also have its own internal regulations on this kind of bulk bill of lading (not a letter of credit settlement is not so strict).

Related requirements:

Must be typed AS PER CHARTER PARTY.

Need to type the date of the CHARTER PARTY.

Need the signature of the captain or OWNER. (Sometimes also can AGENTAS THE CARRIER)

For this bulk cargo, because the goods are loaded directly onto the ship, unlike walking the cabinet as loaded to the container cabinet and then loaded onto the ship, so the captain of the division of responsibility is very concerned about a little bit of faults will also be singled out, or unloading he was afraid of being the consignee to pick the eye of a needle. After the shipment of the first mate receipt copy should also get hand to see what bad endorsement there is not.

L / C way under the different date of issue should be when to start counting

If L / C requirements for the delivery of documents from the date of issue of shipping documents (date of issurance) in the received b / l in the on board date and b / l date of issue is different from what date should be calculated?

The first opinion: Since the letter of credit stipulates that "the date of delivery of the starting date for the date of issue of freight documents", then "received b/l in the on board date and b/l date of issue is different" in the case, should still be according to the letter of credit Provisions, from the "date of issue of shipping documents", and should not consider the received bill of lading on board date.

Second opinion: should be calculated from the date of on board, first of all, date of issurance is the date of insurance documents, rather than the date of on board and b/l date of issue; Secondly, in the CIF and CIP terms, the goods have been transferred to the buyer after the risk of the ship crossing the ship's side, so date of issurance should be the date of on board rather than the date of b/l date of issue. not the date of b/l issuance.

L/C with double expiration, how to ship the delivery date in advance?

For L/C with double expiry, what is the delivery date if the shipment is made in advance under L/C?

Some L/Cs provide for the shipment period and the validity of the L/C is the same day, this is the so-called "double expiration", then in order to ensure that there is enough time to change the order, delivery time, should be shipped in advance, leaving time to change the order and delivery time. If the letter of credit does not provide for the delivery of documents, in the final loading period of more than 21 days before shipment, should be in the bill of lading within 21 days after the date of delivery. If the shipment is made within 21 days before the final loading date, it is sufficient to deliver the documents before the expiration of the L/C.

L/C Risk Prevention and Control

1、What are the risks of L/C payment method?

2、How to prevent and control L/C risk?

Risks of L/C payment method

Risk 1: the importer does not open the letter of credit in accordance with the contract

Importers maliciously do not open the letter of credit in accordance with the contract, in the terms of the letter of credit to increase some of their own favorable terms, common changes in packaging, modification of the latest date of shipment, the amount of the letter of credit, etc., once the original letter of credit is issued, the exporter is in a passive position.

Risk 2: Importers intentionally set up soft terms

Deliberately create difficult to fulfill the terms, for example, in the letter of credit 46A requires the submission of 3/3 of the bill of lading, and 47A requires an original bill of lading sent directly to the applicant for the issuance of a letter of credit, an obvious contradiction and inoperative.

Risk 3: Letter of credit contains effective type of letter of credit

Be alert to the letter of credit containing effective or non-effective clauses, such as the customer's signature before negotiation and delivery of orders, effective with the notification, the need for buyers and sellers to open documents to confirm that the letter of credit is effective, effective after the destination port inspection.

Risk 4: Requirements stipulated in the letter of credit differ from local laws and regulations

Therefore, before the buyer and seller open the letter of credit need to confirm the type of letter of credit, such as not accepting the forward days of the letter of credit, you can also negotiate with the buyer to modify the letter of credit for the false forward, in order to avoid the possible delay in the collection of foreign exchange risk for the exporter as well as the generation of additional costs.

Risk 5: Issuing bank risk, i.e. credit risk

A letter of credit is a conditional payment promise made by the issuing bank with its own credit as a guarantee. Therefore, the biggest risk in the letter of credit business is actually the credit risk of the issuing bank. If the creditworthiness of the issuing bank is poor, all the rights and interests of the beneficiary will not be protected.

Therefore, in the conclusion of the contract, the applicant can be required to open a letter of credit through the bank with our bank has business transactions and better creditworthiness of the bank. At the same time, we should pay attention to the credit investigation of the issuing bank, and not accept the letter of credit issued by the bank with poor credit, or ask for confirmation.

How to prevent and control L/C risk

Step 1: Make friends carefully

Before the buyer and seller enter into a contract, they must carefully choose a trading partner and make a preliminary research on the company's size, capital status and creditworthiness. Choose the right, favorable to the exporter's trade terms. In the conclusion of the contract, the choice of appropriate trade terms for the control of fraud risk is of great significance, in the choice of trade terms as far as possible to choose the exporter to arrange transportation of trade terms, such as: CFR, CIF, CIP, CPT, so that the chartering of ships and booking of cargo insurance options and cargo risk can be controlled in their own hands, can prevent the importer and the forwarding agent collusion to implement the act of letter of credit fraud.

Step 2: Reasonable conclusion of the terms of the letter of credit

The terms of the letter of credit should be simple, clear and concise. Therefore, the terms and conditions of the letter of credit must clearly stipulate the basic information such as documentary requirements, mode of shipment, date of shipment, etc. The terms and conditions must be clear and concise to avoid ambiguity.

Step 3: Reasonable selection of letter of credit types

Try to avoid transferable letters of credit, under the transfer of letters of credit is generally the exporter as the second beneficiary, the second beneficiary shipments, ready to arrange for the delivery of documents to the first beneficiary of the bank (Bank A), Bank A will notify the first beneficiary to change the documents to the first beneficiary's letterhead, and then arranged by the Bank A to exchange documents sent to the final buyer of the issuing bank.

Change this action, the initiative is in the hands of the first beneficiary, the second beneficiary and can not be very good control of the change of this action will be a problem, if once the first beneficiary to submit the documents have problems, resulting in the failure to receive the payment of the issuing bank, as the second beneficiary, even if the quality of the goods, the shipment time, the documents are not a problem, there is still the risk of not receiving the payment of the goods.

In short, the collection of the second beneficiary is completely subject to the first beneficiary, so exporters should be careful to choose this type of L/C settlement.

Summarize the L/C payment method

1, Advantages: bank credit, more secure.

2, disadvantages: complex and cumbersome procedures, more stringent requirements for documents, higher bank fees.

L/C payment method advantages

When the letter of credit settlement, the beneficiary (exporter) of the collection of security, especially in the exporter is not very understanding of the importer, in the importing country has foreign exchange control, the superiority of the letter of credit is more significant.

L / C payment method disadvantages

The review of documents and other links to be more technical, increasing the cost of business, more occupied buyer's funds, which involves at least four roles: letter of credit applicant, issuing bank, notification of the bank, the letter of credit beneficiary.

Easy to generate fraud, due to the letter of credit is a self-contained document, the bank concerned only deal with the characteristics of the documents, there will be false documents.