In the next five years, the dry bulk shipping market will continue to invest in traditional power ships

Sunny Worldwide LogisticsIt is a logistics company with more than 20 years of transportation experience, specializing in markets such as Europe, the United States, Canada, Australia, and Southeast Asia. It is more of a cargo owner than a cargo owner~

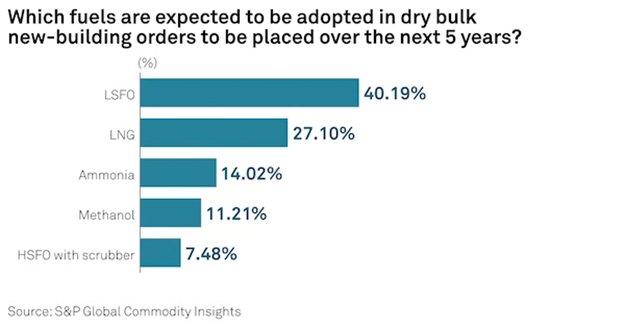

A survey by S&P Global Commodity Insights shows that despite the maritime industry's push to decarbonize and alternative fuels,But only a third of dry bulk shipping operators expect new orders over the next five years to use alternative fuels.

The survey was conducted in November and included 112 respondents including shipowners, ship operators, charterers, shipbrokers and analysts.

Many shipowners are reluctant to order new ships due to a lack of clarity on reliable and readily available zero-carbon alternative fuels.The International Maritime Organization stipulates that from January 1, 2023, ships must obtain energy efficiency certification, namely the Existing Ship Energy Efficiency Index (EEXI).

From 2023, ships will also need to collect CO2 emission data and report annual operational carbon intensity indicators (CII), according to which, ships will receive ratings from A to E in 2024. Ships rated D for three consecutive years or E for one year must develop a correction plan to improve their rating.

In the survey, most participants expected that in 2023, the earnings or returns of different dry bulk ship types such as Capesize, Kamsarmax/Panamax and Ultramax/Supramax will be almost the same, and the market will be generally depressed.New emissions regulations could also lead to a multi-tiered market based on ships' environmental ratings and energy efficiency specifications, respondents said.

Fuel oil remains the backbone of dry bulk shipping

Nearly 48% of respondents expect that only a small number of new orders in the next few years will still be fuel-driven, while the remaining orders will use LNG (27%), ammonia (14%) and methanol (11%).

At present, most investors are very cautious about ordering new ships, partly because of the higher quotations from shipyards.Marc Pauchet, director of dry bulk research at Maersk Broker, said that with no clear indication of which fuel is best, most shipowners are likely to rely on the second-hand ship market to expand their fleets.

Rishi Nyati, general manager of Emarat Maritime, said that there is currently no clear alternative to LNG, but LNG cannot meet the decarbonization goals set by the maritime industry, while methanol, ammonia and hydrogen are still niche options.

A second-hand ship broker said that the cost for shipowners to adopt alternative fuels is high, especially for small dry bulk vessels.. Only 5% of well-capitalized shipowners will risk investing in new technology ships, and only a few advanced economies can support these investments through tax breaks and other incentives.

Regardless of economic feasibility,Multiple market sources said many shipyards continue to promote traditional fuel-based designs, with some offering the option to switch to alternative fuels such as ammonia or methanol.

Newly designed ships have improved fuel efficiency compared with designs from 10 years ago, which has also had a negative impact on the use of new fuels. A handysize ship owner said that the newly designed ships have very low fuel consumption, even lower when sailing at environmentally friendly speeds.Environmental speed will help ships maintain good emissions ratings for at least the next five years.

Drewry said that currently about 6.5% of orders are dual-fuel propulsion, and ships can use fuel oil or LNG.Jayendu Krishna, deputy director of Drewry Marine Consulting, said shipowners are also looking for other ways to optimize fuel consumption and reduce carbon emissions., technologies such as shaft generators, air lubrication systems, ship route optimization, meteorological alignment and wind-assisted propulsion will be increasingly widely used.

The second-hand ship market is growing rapidly

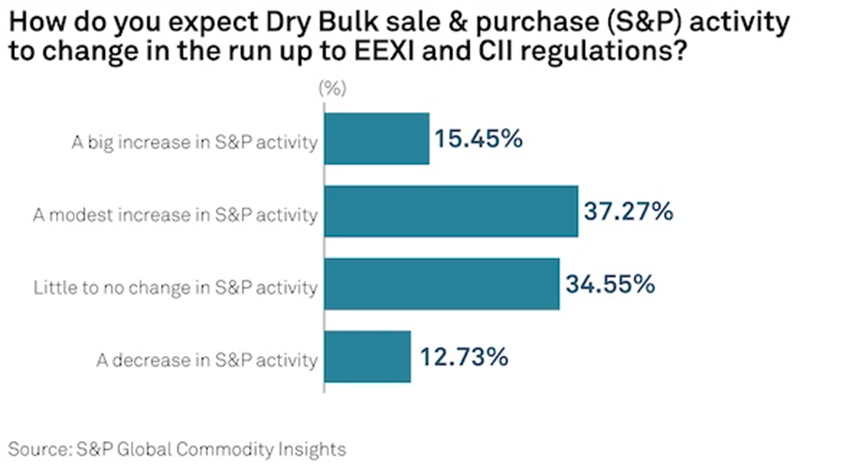

As new ship orders decline,The second-hand ship trading market is expected to remain strong in 2023, with only 12.73% of survey respondents expecting the ship trading speed to slow down.

Pauchet expects demand for second-hand dry bulk carriers to continue to increase. Market sources also expect second-hand ship prices to exceed new ship prices in the coming years.

According to industry insiders, as of November this year, more than 600 dry bulk carriers have changed hands, while there will be about 900 ships in 2021 and about 550 ships in 2020.

Market observers expect thatDue to tight shipyard slips before 2025, investors will rapidly expand shipping capacity through the second-hand ship market.

Some second-hand ship brokers said that due to low attention to CII and EEXI regulations,The second-hand ship trading market only reflects the situation of the spot market.