There are too many risks in L/C, how to prevent them? Here are the explanations for many problems with letters of credit!

Sunny Worldwide Logistics which have more than 20years logistics shipping experience,which take care of the goods more than the owner.

Therefore, letter of credit payment is also a trend in international trade!

How to define letter of credit payment method

What does a letter of credit include?

(3) Transportation requirements.

When is the issue date different under the L/C method?

4. How does a letter of credit work?

(7) After the issuing bank verifies that the documents are correct, the payment is made to the negotiating bank.

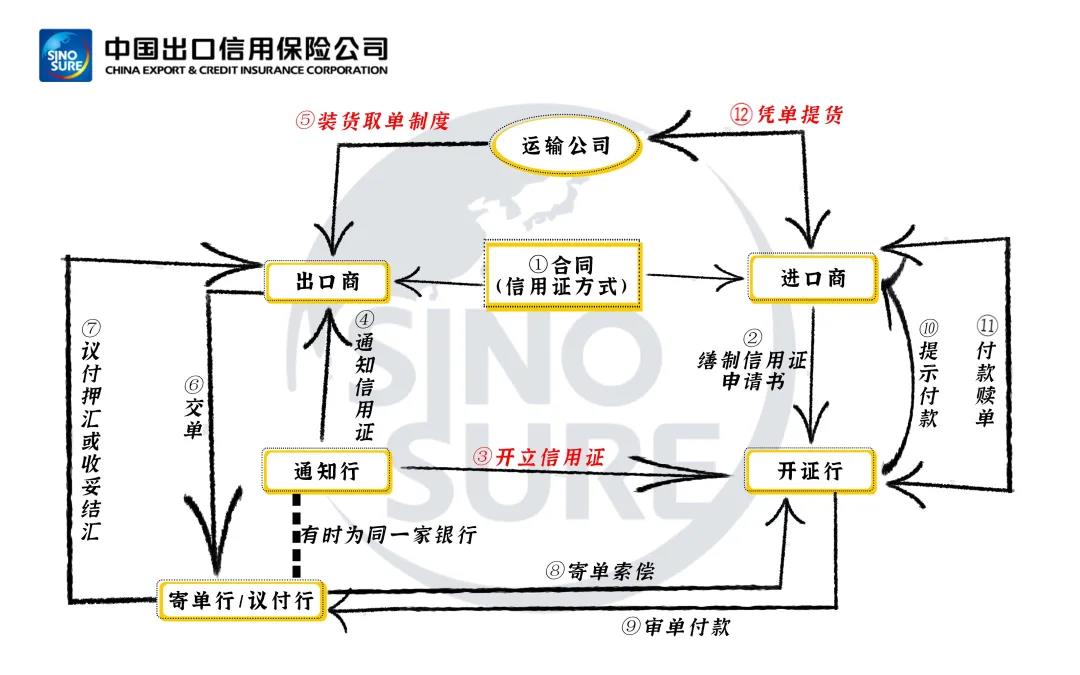

How a letter of credit works

1. What is a letter of credit?

2. Why is there a letter of credit?

3. What does the letter of credit include?

4. How does the letter of Credit work?

How to define a letter of credit payment method

(6) The issuing bank’s responsibility to guarantee payment to the beneficiary and the holder of the bill of exchange.

Why is there a letter of credit

2. Disadvantages: The procedures are complex and cumbersome, the document requirements are strict, and bank fees are high.

(4) Requirements for documents, namely cargo documents, transport documents, insurance documents and other relevant documents.

What does a letter of credit include

1. What are the risks of L/C payment method?

1. What is a letter of credit?

(3) Requirements for transportation.

3. What does a letter of credit include?

(5) Special requirements.

Step 3. Choose the type of letter of credit reasonably

(8) The issuing bank notifies the issuer to pay the redemption order.

2. Why is there a letter of credit?

How Letters of credit work

FAQs when choosing L/C payment method

Risk 1: The importer does not issue the certificate in accordance with the contract

▲Letter of Credit (L/C) overview diagram

For L/C with double expiry, how about early shipment and bill delivery period?

The date of CHARTER PARTY needs to be marked.

Step 2. Establish reasonable letter of credit terms

Application of L/C in FOB terms

How to prevent and control L/C risks

Frequently asked Questions when choosing L/C payment method

L/C risk prevention and control

Risks of L/C payment method

(5) Special requirements.

Application of L/C in FOB terms

1. How to apply L/C under FOB conditions?

(6) The negotiating bank sends the bill of exchange and shipping documents to the issuing bank or its specific paying bank for claim.

Related requirements:

Must be listed AS PER CHARTER PARTY.

The date of the CHARTER PARTY needs to be typed.

Why is there a letter of credit payment method?

The products are similar and the prices are similar. If others can accept LC, do you accept it?

Step 1. Make friends carefully

Risk 3: The letter of credit contains an effective letter of credit

First opinion:Requires captain's or OWNER's signature. (Sometimes it can also be AGENTAS THE CARRIER)

Second opinion:(3) The advising bank will hand over the letter of credit to the beneficiary after verifying that the seal is correct.

Disadvantages of L/C payment method

Summary of L/C payment methods

(2) The issuing bank issues a letter of credit to the beneficiary based on the content of the application and sends it to the advising bank where the exporter is located.

L/C Risk prevention and control

1. What are the risks of L/C payment method?

2. How to prevent and control L/C risks?

L/C Risks of payment methods

Risk 1: The importer does not issue the certificate in accordance with the contract

Risk 4: The requirements stipulated in the letter of credit are inconsistent with local laws and regulations

related requirements:

Risk five: Issuing bank risk, that is, credit risk

Second opinion:

3. How about shipping the L/C in advance and delivering the bill in advance?

2. How to prevent and control L/C risks?

(8) Inter-bank wire transfer claim clause (t/t reimbursement clause).

For a double-due L/C, if the L/C is shipped in advance, what will be the bill delivery period?

Advantages of L/C payment method

100% TT in the short term, TTDP in the medium term, and LC for long-term customers. Do you accept it?

Customers want to use Paypal for small orders, TT for medium orders, and TTLC for large orders. Do you accept it?

How to prevent and control L/C risks

Step 1 Choose your friends carefully

Step 2. Reasonably conclude the terms of the letter of credit

(2) Requirements for goods. Describe according to the contract.

Step 3. Choose the letter of credit reasonably

(5) The negotiating bank will advance the payment to the beneficiary after reviewing the documents according to the terms of the letter of credit.

(1) Description of the letter of credit itself. Such as its type, nature, validity period and expiration place.

1. Advantages: bank credit, relatively safe.

Make a summary of L/C payment methods

First opinion:

Must be marked AS PER CHARTER PARTY.

L/C Payment method advantages

2. When is the issue date different under the L/C method?

L/C Payment method disadvantages

Learn more about letter of credit payment methods in detail and systematically

Risk 2: Importers deliberately set soft terms