The difference between the RCEP certificate of origin and the existing free trade zone certificate of origin

According to the General Administration of Customs Announcement No. 106 of 2021 (General Administration of Customs Announcement on Matters Related to the Implementation of the Regional Comprehensive Economic Partnership Agreement (RCEP)), the new Regional Comprehensive Economic Partnership Agreement Certificate of Origin will be issued fromIssuance will begin on January 1, 2022.

RCEP has some new changes in rules of origin, visa operating procedures, etc. Below, the editor will take you to find out the differences between the RCEP certificate of origin and the existing free trade zone certificate of origin!

1Certificate filling requirements have changed

For the first time, the RCEP certificate of origin can be associated with more than two invoices for the same batch of goods;

The country of origin is no longer limited to the country where the exporter is located, but extends to RCEP member states;

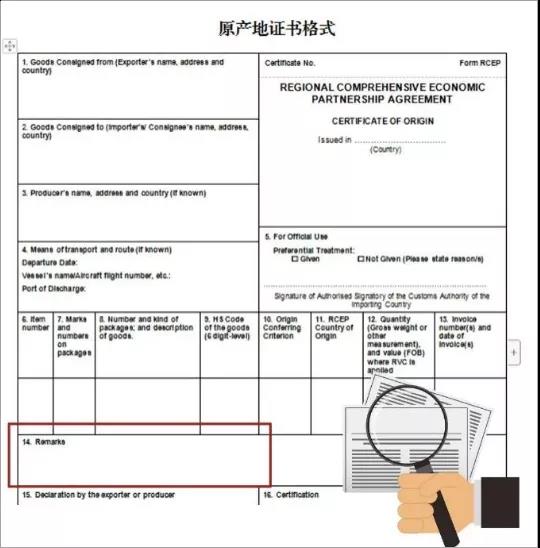

The certificate adds a 14th column of remarks to better meet the needs of applicants.

2More abundant forms of certificate of origin

Added declaration of origin and back-to-back certificate of origin;

When the RCEP Agreement takes effect, approved exporters can apply for a declaration of origin, which will later be expanded to be issued by the exporter or manufacturer;

Back-to-back certificate of origin means that after the original exporting party has issued the certificate of origin, the relevant goods have been packed, loaded, unloaded, warehousing, split, labeled and other operations permitted by RCEP in the intermediate party, and the intermediate party will issue it again certificate of origin. This measure is more adaptable to the needs of modern international logistics and will facilitate the transportation and logistics splitting of goods among members without affecting their origin qualifications.

3Cumulative rules apply more broadly

Compared with most free trade agreements in the world, which are bilateral rules of origin,RCEP can use intermediate goods from multiple parties within the agreement to meet the required value-added standards or production requirements., greatly lowering the threshold for goods to enjoy tariff reductions.

4Regional value component calculation method added

In addition to the indirect/deduction formula, RCEP also adds a direct/accumulation formula, which makes the calculation method more flexible. Enterprises can choose their own formula for calculation according to the actual situation.

5Direct shipping rules are more convenient

RCEP direct transport rules and regulations: At the request of the customs of the importing member, the customs documents or other appropriate documents of the intermediate member or non-member shall be submitted, including commercial transportation or freight documents, copies of the original commercial invoices of the relevant goods, financial records, non-reprocessing certificates or import contracting parties. Other relevant certification documents required by the customs of the country. There is no mandatory requirement that when goods are transferred, certification documents issued by the customs of other countries or regions or other certification documents recognized by the customs must be submitted.

6Changing the certificate processing form is more flexible

RCEP has two options for changing certificates. Applicants can apply for correction to the original visa agency with the original certificate of origin within 1 year from the date of issuance of the certificate of origin.

The issuing agency can choose to make changes to the original certificate and sign and stamp the corrections, or it can choose to issue a new certificate of origin and invalidate the original certificate of origin.

7The discount program is more user-friendly

RCEP adds circumstances under which benefits cannot be refused, including minor errors in third-party invoices and documents;

An importing Party shall not deny preferential tariff treatment solely because a third-party invoice is not issued by the exporter or manufacturer of the goods;

Where there is no doubt as to the origin of the goods, the customs administration of the importing Party shall ignore minor errors including minor differences between documents, omissions of information, typographical errors or the highlighting of specific fields.