The backlog of ships outside the Port of Los Angeles has decreased, the cargo handling volume has set a record, and the congestion of the Eastern United States ports is still serious

The Port of Los Angeles released its March container throughput report on Tuesday, which came in better than expected at 958,674 TEU. It was the port's best March ever for container throughput figures. In the first quarter of this year, total cargo volume at the Port of Los Angeles reached 2,682,034 TEU, an increase of 3.5% over the same period last year, completing the best first quarter ever.

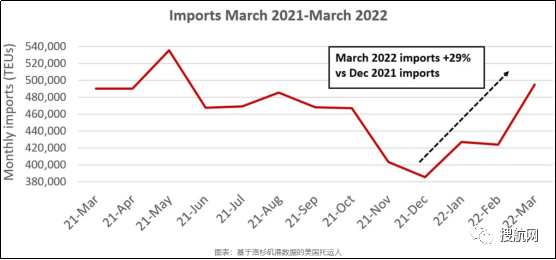

The month-on-month surge in imports was particularly pronounced. Import shipments in March were up 17% from February and 29% from December, which was at its lowest level since June 2020, when the U.S. was in lockdown.

Gene Serok, executive director of the Port of Los Angeles, said in announcing the monthly data that in March 2022, container imports reached 495,196 TEU, up 1% year-on-year; container exports were 11,781 TEU, down 9% year-on-year. Exports from the Port of Los Angeles have declined in 37 of the past 41 months.

Record volumes of freight have been stuck in ships lining up outside the port. Actual shipments arriving in California from Asia in March should be seasonally reduced due to the Chinese New Year holiday in February. But as more ships were lined up to unload, import box handling surged.

The number of container ships waiting near the Port of Los Angeles/Long Beach fell 20% from 60 to 48 in early March to the end of March, according to data from the Southern California Maritime Exchange.

"I think that's why we had a strong first quarter," said Gene Seroka. "First of all, our terminals are handling cargo at record levels, and we have berths at the terminals, with improved terminal liquidity and a reduction in the backlog of vessels outside the port. There’s also more room to deploy on the dock. Two, we have more workers on the dock. Three, we’re using more data than ever before.”

When the supply chain crisis finally lifted, it looked like it should have been an increase in imports at first, followed by a downturn. The number of waiting ships at the Port of Los Angeles follows the first part of this pattern, but this may only be a temporary relief. Not only is the rate of decline in queues on the West Coast slowing, if not reversed, but port congestion on other coasts is still very high.

On April 4, the container ship queue at the Port of Los Angeles/Long Beach dropped to 33. There were 46 container ships waiting on Tuesday morning, up 39% from the lows.

Vessel position data from MarineTraffic showed that the number of vessels in queue remained high Tuesday afternoon near ports on the East Coast/Gulf Coast. A total of 64 container ships are waiting to berth, including 16 in the Port of Charleston, South Carolina, 13 in the Port of New York/New Jersey, 12 in the Port of Houston, 11 in the Port of Virginia, and 6 in the Port of Savannah, Georgia. There are three ships in Freeport, Bahamas, and one each in Philadelphia, New Orleans and Jacksonville, Florida.

At the same time, there is no evidence yet of a significant drop in import shipments. FreightWaves has a proprietary seaborne import cargo volume index to the United States, measured in TEU, indexed to January 2019. The index remained above 200, about the same as a year earlier.