Another 10% increase, the US-West shipping fee will return to 2,000 US dollars; CMA CGM will charge a peak season surcharge!

NO.1 Increased by another 10% in a single week, and the US-West freight returned to US,000

According to the latest data from Drewry, the sea freight rate for exports from Shanghai to the Port of Los Angeles in the west of the United States has increased by 10% in a single week after rising for two consecutive weeks. The freight rate climbed to US65/FEU, approaching the US00 mark.

This is the third week in a row that the freight rate of the US-West route has risen, with a cumulative increase of 24.3%. At the same time, the freight rate of Shanghai to New York port in the east of the United States rose by 7% to 2906 US dollars / FEU.

Drewry said: "The combination of lower capacity due to increased suspensions on the trans-Pacific eastbound route, delays caused by strikes on the Canadian west coast, and a more positive outlook for North American cargo demand have combined to drive the recent increase in trans-Pacific eastbound ocean freight volumes.

NO.2 UPS strike may cause .1 billion in losses

The 10-day UPS strike could become the costliest shutdown in U.S. history, according to an estimate by a Michigan-based economic research firm that studies the cost of workforce disruption. According to preliminary estimates, it may cause a loss of 7.1 billion US dollars to the US economy.

Anderson Economics estimated the hit to businesses and consumers alone would be .6 billion, with "significant and lasting harm to small businesses, home workers, self-employed workers and online retailers across the country." Other costs include an estimated 6 million in direct losses to UPS and .1 billion in lost wages for the company's 340,000 Teamsters union members, with the remaining costs to be borne by UPS suppliers and lost tax revenue.

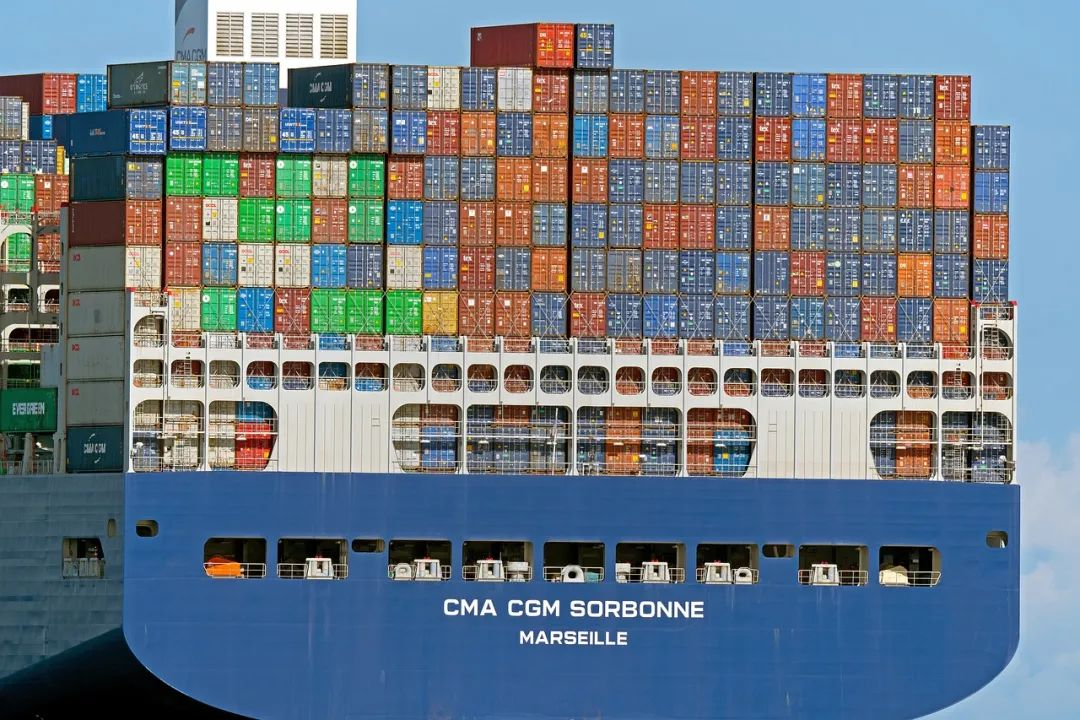

NO.3 CMA CGM will charge peak season surcharges for routes from Asia to South Africa

CMA CGM recently announced that it will impose a new peak season surcharge (PSS) on routes from Asia to South Africa, which will take effect on August 21.

The scope of application of the new fee includes: Northeast Asia, Southeast Asia, Mainland China, Hong Kong, Macau and Taiwan to South Africa.

The charging standard is USD 300/TEU, involving dry container, cold container, out-of-gauge (OOG) cargo and general cargo.

NO.4 ONE launched a new service connecting the Adriatic Sea, Israel, Egypt and Greece

Singapore-based container shipping company Ocean Network Express (ONE) will start a new feeder service linking Adriatic ports, Israel, Egypt and Greece.

ONE’s new Adriatic Israel Butterfly Ring Service (AIB) is expected to provide a new gateway for customers in the European and Mediterranean regions.

The new weekly service is scheduled to depart from Port Damietta on August 16 and will have a 21-day round trip.

NO.5 COSCO SHIPPING North America Warehouse Distribution Service Products are fully launched

COSCO SHIPPING's official account recently announced that as an important strategic part of COSCO SHIPPING's digital supply chain, its North American warehousing and distribution business has been fully launched, with a total area of more than 1.19 million square feet, covering Chicago, Atlanta, Los Angeles, Charleston, Savannah, Tuscaloosa, Dallas, Houston and other places.

This move marks that COSCO SHIPPING's supply chain service products are closer to end customers. After the customer's goods arrive at the North American port, they can be stored in the nearest warehouse of COSCO SHIPPING, and then delivered to all parts of the United States on demand.