Prospects for the three major ship types of transportation market

2021-2023 CCFI trend comparison chart

In the short term,demand side, U.S. retail sales in December 2022 decreased by 1.1% month-on-month, the largest month-on-month drop in 2022; the global manufacturing PMI in December 2022 released by JP Morgan fell to 48.6, of which the export order index fell to 46.1.These all indicate that short-term demand remains weak. On the supply side,According to Clarksons statistics, the 7-day moving average of the proportion of container ship capacity in port to the total capacity is 31.5% on January 26, 2023, which is close to the average level of 31.6% from 2016 to 2019; Alphaliner data shows that in response to insufficient demand In the first seven weeks of 2023, liner companies cut capacity by 27% on the Asia-Europe route.Freight, Xeneta, the freight rate publishing agency, stated that in view of the fact that the spot freight rates of some routes are already close to or lower than the operating costs of liner companies,The room for spot freight rates to fall has been very limited.However, considering that after the Chinese New Year is the traditional off-season for freight,Freight rates are expected to continue to adjust. In terms of different routes, the small and medium-sized ships that entered the main line when the market was high in the early stage returned one after another, resulting in greater downward pressure on the freight rates of the routes in Asia; the freight rates of the trans-Atlantic routes, which are still at a relatively high level, will also decline, gradually moving to other routes. The level of profitability is close.

According to the predictions of Alphaliner and Drewry, the growth rate of global port container throughput in 2023 will be 1.4% and 0.8% respectively, and the growth rate of shipping capacity will be 8.2% and 1.9% respectively; distance) were -2.2% and 1.4% respectively, and the growth rate of transport capacity was 6.7% and 6.4% respectively.Drewry estimates,The average global container freight rate (including fuel surcharges) in 2023 will be 62% lower than in 2022, but still 18% higher than in 2019. influenced by,The combined EBIT of the global liner industry is expected to be US billion in 2023, down from US0 billion in 2022 but higher than US.5 billion in 2019.

-Dry Bulk Shipping Market-

2021-2023 BDI trend comparison chart

According to Clarksons latest dry bulk monthly report,In 2023, the growth rate of global dry bulk shipping turnover will reach 2%, the growth rate of seaborne trade volume will be 1.3%, and the growth rate of fleet will be 1.8%.

By type of goods, in 2023iron oreThe volume of seaborne trade was 1.483 billion tons, with a growth rate of 0.1%;coalThe volume of seaborne trade was 1.25 billion tons, with a growth rate of 2.1%;foodThe volume of seaborne trade will be 531 million tons, with a growth rate of 5.1%;Small bulk cargoThe trade volume was 2.054 billion tons, with a growth rate of 0.6%.

-Tanker Transportation Market-

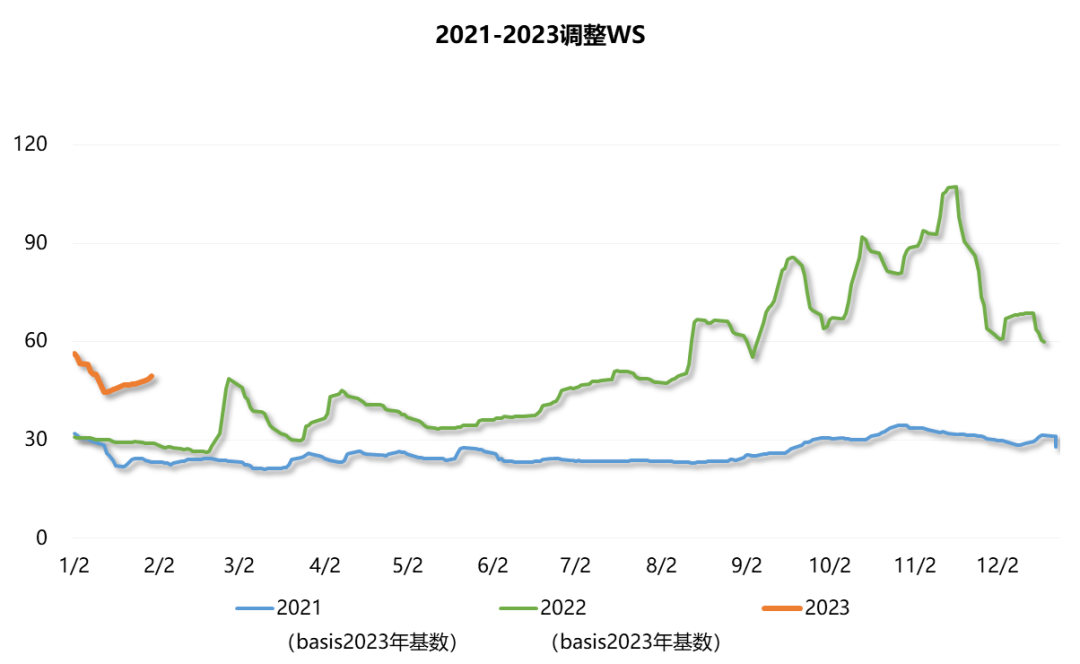

2021-2023 Middle East to China TD3C route WS trend comparison chart

In the short term,Refineries resume work at a faster pace after Chinese New Year, It is expected to support the recovery of the spot freight rate of oil tankers. In the long run, the tanker market will show a weak recovery in 2023.

demand sideAt the same time, the regional energy trade pattern is further deepened, Russia's oil exports are less affected by the EU ban, and China and India have become the main export direction. At the same time, the EU's import of US oil and natural gas Increased dependency.The three major institutions are optimistic about the growth rate of global oil demand in 2023In addition to OPEC maintaining its forecast of 2.22 million barrels per day last month, the IEA and EIA raised their forecasts by 200,000 barrels per day and 50,000 barrels per day to 1.9 million barrels per day and 1.05 million barrels per day, respectively.

On the supply side, the dismantling of old ships has not yet accelerated, and the delivery of crude oil tankers has gradually increased. The spot market will continue to be under pressure in the future.

Clarksons forecast, 2023crude oil tankerDemand increased by 6.5%, and supply increased by 1.9%, of which VLCC demand increased by 7.8%, and supply increased by 3%.product tankerDemand increased by 9.3%, and supply increased by 0.4%. Due to the large base of accumulated capacity in the early stage, it still takes time to digest.