Container prices have soared by 94% in five months, and the shortage of containers in Asia will intensify. North America is the main cause of global container shortages.

Jim

Sunny Worldwide Logistics

2021-04-20 18:12:28

A series of unusual events triggered by the epidemic and the Suez Canal accident led to a serious container shortage crisis. This situation can be classified as global, because the shortage of containers will have a knock-on effect on all supply chains and fundamentally disrupt international trade. Due to the strong demand in North America, a large number of containerized cargoes from Asia are shipped to North America, and only a few containers are shipped to Asia. So far this supply asymmetry has evolved into a terrible imbalance. There are reports that North America has become a global container shortage. The main reason.

At this month's press conference, Hapag-Lloyd CEO Rolf Habben Jansen stated that the current market conditions have increased container usage time by approximately 20% compared to before the outbreak. "In fact, this means that the same amount of goods requires an increase of about 20% of the boxes." He said. Shipping companies have been busy extending lease periods at higher prices and are actively purchasing additional containers from each leasing company. Both in terms of daily rent and lease terms, their bids will exceed their competitors.

▍Average container price surged 94% in the past 5 months Container leasing company Triton, which has more than 25% of the liner market, described the transaction as "extraordinarily strong" after reporting record profits in the last quarter of 2020. As shipping companies keep their containers longer than before, the prices of new and old containers are soaring. According to data from the online leasing and trading platform Container xChange, from November last year to March this year, the average price of second-hand 20'-foot containers soared by 94% to US$2,521.

Johannes Schlingmeier, founder and CEO of Container xChange, said: “Since the summer of 2020, the continued growth momentum of container transport trade has not slowed down, which is reflected in the shortage of containers in Asia and other regions.” He added: "We expect that the market will tighten further in the coming weeks due to the chain reaction of the Suez Canal closure further disrupting the availability of shipping services and containers."

The price of a good 5-year-old second-hand container is now much higher than the price of a new container before the epidemic. Schlingmeier said: "It depends on the exact container type. Before the shortage becomes serious, the price of a standard old container in China that has been used for several years is around US$1,000, while the price of a new container is about twice this price. ." “In the current market, the price of second-hand containers in China is between US$2,300 and US$2,600, while the price of new containers, such as in Shanghai, has soared by 64% this year, reaching an average of US$3,390.” ▍North America is the main cause of global container shortage As the import demand in the United States continues to grow, the blocked logistics chain continues to slow down the turnover of containers. The difficulty of purchasing containers in Asia is increasing. According to JOC, the shortage of containers in Asia will intensify in May.

The latest analysis by the Danish maritime consulting company Sea-Intelligence shows how much North America is responsible for the serious container imbalance in the global shipping industry. According to Sea-Intelligence's analysis, before the outbreak, North America was structurally responsible for 40-45% of the unbalanced containers needed in Asia. This situation has changed drastically after the early fluctuations in the epidemic. North America is now structurally responsible for 55-60% of the Asian box imbalance. Sea-Intelligigence warned in its latest weekly report that structural supply chain imbalances related to empty containers are not yet close to normalization.

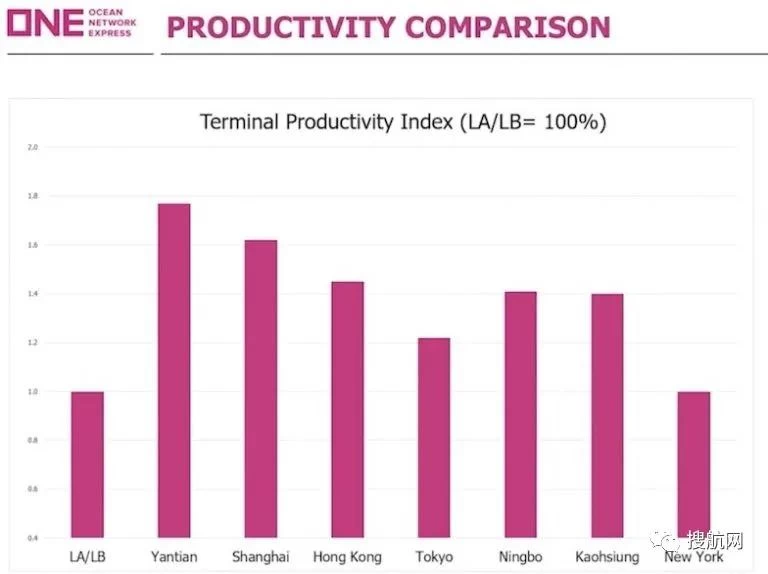

The Sea-Intelligence report stated: “The imbalance now needs to be corrected through North America. At the same time, North America is the place where port congestion is the most serious, which slows down the effort to return containers.” At this year's TPM meeting, the world's largest container shipping event, the issue was extensively discussed. Jeremy Nixon, CEO of Japanese liner company Ocean Network Express (ONE), pointed out at the meeting that due to fewer working hours, North American terminal productivity is 50% behind its Asian counterparts.

Vincent Clerc, CEO of Maersk, the world's largest container shipping company, stated in the same incident that underinvestment in the North American coastline is a key part of the current reserve container crisis. The Federal Maritime Commission, the US regulator, is investigating the availability of containers as part of an extensive investigation into the supply chain chaos that has hit US ports, retailers and exporters in the past eight months. The latest data from PIERS, which tracks U.S. imports and exports, shows that compared with March 2020, the volume of container shipments from Asia to the U.S. increased by 90% in March. Even if the data from March 2021 is compared with March 2019 before the pandemic, its traffic growth has reached a record 57%.