The utilization rate of container ships continues to decline, and container prices and spot freight rates may continue to fall!

The average price of containers in August fell by more than half from a year earlier, following a recent rebound in container trade in China, according to an analysis published Thursday by container online trading and leasing platform Container xChange.

Christian Roeloffs, co-founder and CEO of Container xChange, said: “It’s peak shipping season and the industry is expecting a massive outflow of containers from China to meet orders from demand centres. This year, we haven’t seen the two major mainstays that were common during this period in previous years. Trends - rising leasing fees and prices for Chinese containers and a drop in the Container Availability Index (CAx)."

Analysis by Container xChange highlights that the Shanghai CAx index is rising on a weekly basis and is well above levels seen in 2020 and 2019 (pre-pandemic). This could mean more containers in China with lower prices, making it easier for shippers and forwarders to plan voyages from China, Container xChange said.

It also highlighted that from June to July, the average one-way price for container rental pickups from China to the United States fell by 17%. In addition, the price of standard containers that can be loaded has plummeted by half in August compared to the same period, the report said.

“As the supply chain prepares for the peak season (usually July to September), the drop in average container prices and lease fees presents a good opportunity for shippers and forwarders,” Container xChange said. “Obviously this gives Cheers to shippers and forwarders looking to get containers out of China," Roeloffs said.

Against the backdrop of falling container costs, maritime data analytics firm Sea-Intelligence reports that the trend in falling demand can be offset by a drop in capacity injections, especially as port congestion causes significant delays to ships, which in turn lead to capacity cancellations.

Alan Murphy, chief executive of Sea-Intelligence, said: "Despite a 0.6% year-on-year increase in demand in June, this does not change the fact that demand has been on a downward trend since the peak season of 2020."

As such, Sea-Intelligence argues, the more relevant question is how demand growth matches deployed capacity.

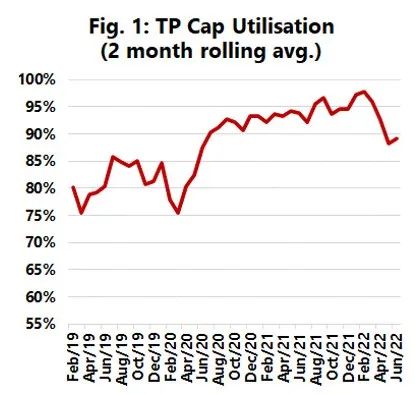

The Sea-Intelligence report said that when looking at the deployment of capacity on the main trade routes between East and West, it can be seen that the growth in capacity is increasing at the same time as demand growth is slowing. forFor the trans-Pacific route, the sharp decline in vessel utilization in May also continued in June, with vessel utilization at around 89%.

Sea-Intelligence noted that there is a correlation between vessel utilization and spot freight rates on trans-Pacific routes.

“Basically, once the trans-Pacific route reaches 90 to 95 percent vessel utilization, which means that all capacity is fully utilized, spot rates will increase significantly,” Murphy said. “Now, we’ve seen two consecutive With vessel utilisation rates below 90% for the month, it is clear that the market is no longer able to sustain extremely high spot freight rates.” At the same time, Murphy also said that a similar situation was seen on the Asia-Europe and transatlantic routes.

On top of that, average vessel utilisation on major trade lanes continues to be below the threshold that drove the record peak vessel utilisation of the past 18 months, Murphy said.

He pointed out, "Therefore,The trend of falling spot freight rates will continue. "