The lack of cabinets may continue until next year. China produces 96% general containers and 100% cold containers worldwide

Jim

Sunny Worldwide Logistics

2021-05-25 18:04:57

Due to the repeated epidemics, the efficiency of the port has been reduced, causing serious congestion, delays in shipping schedules, and slow movement of containers in the transportation network, which cannot be used effectively. At present, the distribution of containers is extremely uneven. Facing the situation that one container is difficult to find, the world’s largest container ship shipping company believes that it may not be until the fourth quarter to return to the level before the epidemic. However, some equipment leasing companies believe that it may continue to In 2022.

This year's container production has also risen sharply, and it is expected to increase by 6%-8% this year. So how many containers are produced in China? The answer is that almost all shipping containers in the world are currently built in China. According to Drewry, a British maritime consulting company, Chinese factories currently manufacture more than 96% of the world’s dry cargo containers and 100% of refrigerated containers, and three Chinese companies account for most of the output. John Fossey, head of container equipment and leasing research at Drewry, believes that as port congestion eases and China is expected to produce a record number of containers this year, the current global container tensions should be eased.

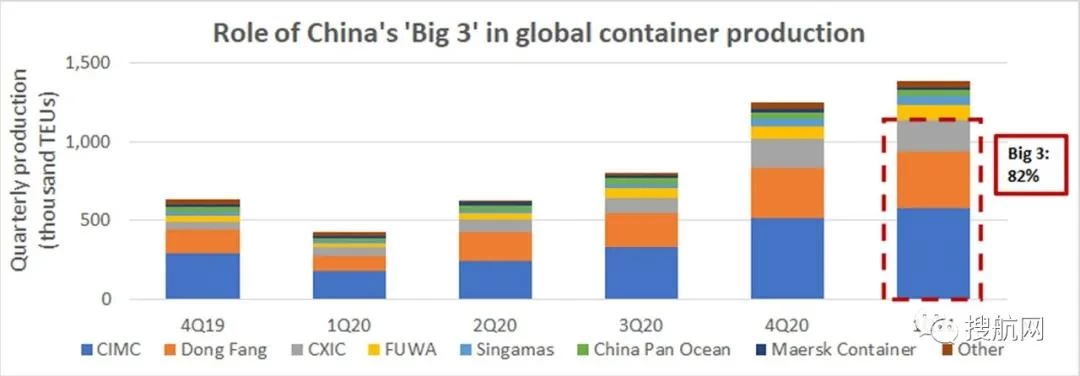

China's three major container manufacturing giants In the 1990s, the container manufacturing industry moved from South Korea to China. Since then, China’s market share has been growing and has been dominant in the past 15 years. According to Drewry's data, in the first quarter of this year, the top three Chinese container manufacturers accounted for 82% of global container production. CIMC Group (CIMC) produced 580,000 20-foot TEUs, accounting for 42% of the market share; Eastern International Container Company produced 358,000 TEUs, accounting for 26% of the market share; New Huachang Group CXIC Group produced 200,000 TEUs, accounting for 14% market share.

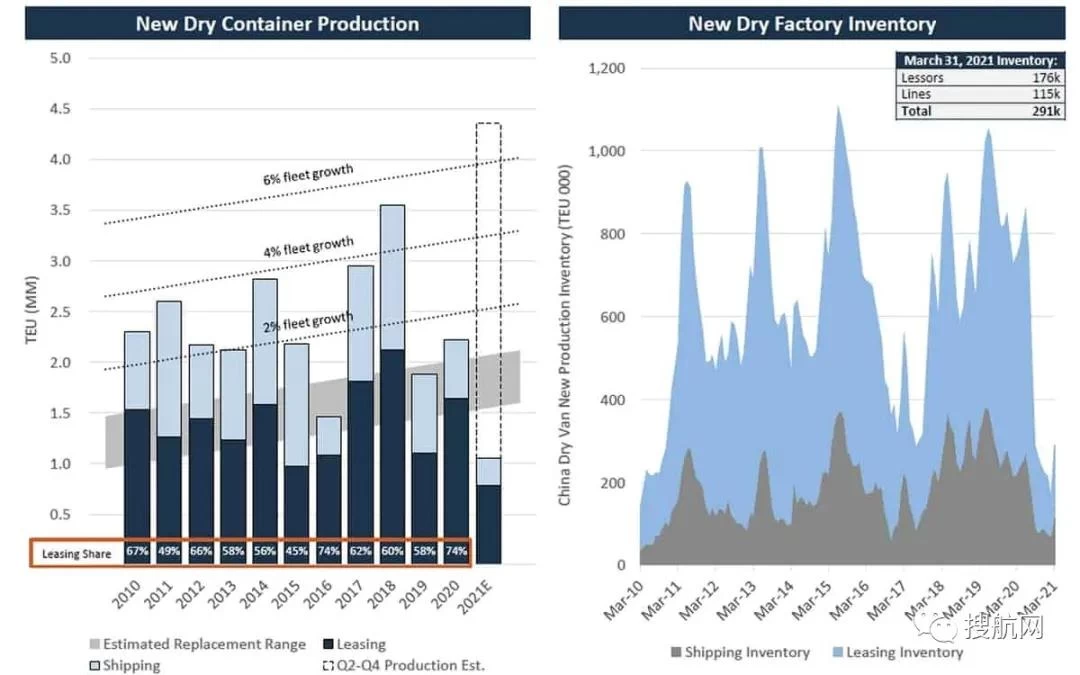

According to Drewry's data, this is roughly the same as the full-year market share in 2020, when the total output was 3.1 million TEUs. Both the price and output of containers are rising sharply Fossey said that from 2017 to the beginning of 2020, container prices have fallen sharply, and manufacturers can only enjoy meagre profits at best. By the end of 2019, the price was only $1,650-1,750/TEU. " "Since the outbreak, due to strong consumer demand in the United States and Europe, the price of containers has started to rise. From the end of 2020 until this year, we have seen prices around 3,500 US dollars." But Fossey said: “The factory can do two 12-hour shifts a day, but they don’t want to fill the market with containers because they try to keep the price at the current or slightly lower level, and don’t want to fall back to US$1,750 or US$1,800 ." At a time when the availability of containers is more important to shippers than ever, this setup may sound worrying. Because it is reported that Chinese container equipment manufacturers increase the price of new containers paid by liner and leasing companies by managing capacity, which is similar to ocean shipping companies managing capacity to support freight pricing.

Fossey said, but China's production decision is not the cause of the shortage of containers in the United States. "Drewry's research shows that, in principle, there are enough containers in operation to meet the needs of global trade. The problem is that all containers are placed in the wrong place, congestion and the movement of containers on the transportation network is quite slow. " At the same time, China’s container output this year is very high-"Even if it is not as high as possible under a two-shift system. Manufacturers have changed from working 10 hours/5 days a day to 10-11 hours/6 days a day. "Fossey said.

If there are any signs in the first four months of this year, it is that Chinese factories are expected to exceed the 2018 record of 4.4 million TEUs, which is equivalent to a double-digit year-on-year growth. Fossey believes that when port congestion is finally relieved, the effective supply of containers will increase and China's demand for new containers will fall. He expects that production will slow down in the second half of the year compared with the first half.