Another shipowner company started to "play with airplanes", is it a good investment?

However, some industry insiders said that the merits of Pan Ocean's investment are puzzling, because such an investment does not seem to bring any synergies to the shipowner company.

According to a recent report by South Korea’s American media Korea Economic Daily, Pan Ocean, a well-known Korean shipowner company and a shipping subsidiary of Harim Group, has purchased Hanjin KAL Corp., the parent company of Korean Air, for 125.9 billion won (about 95 million U.S. dollars). 10,000 shares, equivalent to 5% of the company's shares.

Together with the original 0.8% stake, this brings the total shareholding held by Pan Ocean to 5.8%, which also means that Pan Ocean has become the fifth largest shareholder of the Korean airline.

Pan Ocean said that the purchase of Hanjin KAL's shares is just a simple investment.

Another media said that Pan Ocean's investment represents its ambition to enter the aviation field.

In fact, in the past two years, a large number of shipping companies have invested and entered the aviation industry.

For example, Maersk, the world's top three container shipping companies, MSC, and CMA CGM have established their own air cargo departments. MSC has established MSC Air Cargo, and CMA CGM has CMA CGM Air Cargo. Maersk Group It also has its own Maersk Air Cargo.

While Korean Air manages an air cargo company called Korean Air Cargo. However, other analysts said that Pan Ocean's investment is far away from its existing business, or may not produce synergies.

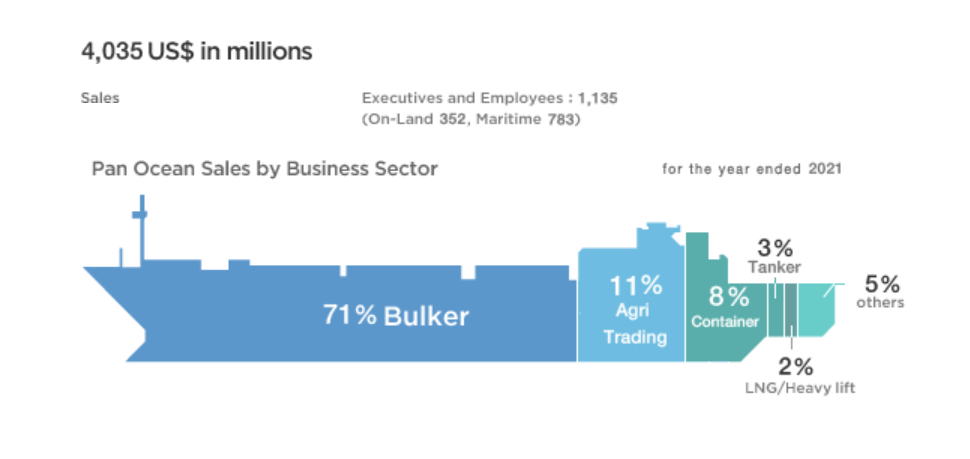

According to the information disclosed on Pan Ocean's official website, about 71% of the group's US billion revenue comes from dry bulk shipping business, while the agricultural product trading business accounts for 11% of the revenue, and the container business only accounts for 8% of the revenue.

Eon Hwang, Korea industrial analyst at Nomura Securities, said, "We don't see any synergies for Pan Ocean with the acquisition of Pan Ocean and Hanjin Kal."

“Pan Ocean explained that the purpose of acquiring a minority stake in Hanjin Kal is to capture capital gains from any potential rise in the share price of Hanjin Kal.”

However, Hwang said the market is aware of the disappointing governance of Pan Ocean Group and its major shareholder Harim Corp, and does not expect it to make shareholder-friendly decisions.

Hwang added: “In our view, Pan Ocean’s past attempt to acquire Easter Airline in June 2021 does not really have any synergies with Pan Ocean either.”

Air freight prices are also falling sharply

During the logistical and supply chain chaos of the pandemic, some shipping lines have started using airfreight to move cargo that would normally be carried by ship due to severe shortages of maritime capacity and time lost due to severe congestion.

As mentioned above, the world's top three container shipping companies have also established their own air cargo companies.

However, as air freight rates have recently begun to spiral down along with sea freight rates, some analysts have begun to express concerns about container companies investing in air freight business.

Niall van de Wouw, chief analyst of Xeneta air cargo, said that during the pandemic, when passenger planes were grounded and cargo could not be delivered, the air cargo business was originally a lucrative business, but now the air freight market is losing its momentum. This may prompt container carriers to reconsider their investments.

“When margins are down in the current ocean freight market, if container lines hit break-even or lose money, I think they’ll revisit these (air freight) businesses,” van de Wouw said.

van de Wouw also expressed his skepticism about the decision of the three major container shipping companies to enter the air freight market.

“When they decided to come in, air freight rates were high. But we are in a completely different era now,” he said of the collapse in freight rates.

“I wouldn’t be surprised if their deep pockets and high freight rates at the time gave them the confidence to say: ‘Hey, let’s do this,’” van de Wouw said. "But the big three could face a dilemma when air cargo rates fall and revenues from the airline's core business shrink."

"What do companies do when things don't go well? They have to focus on their core," van de Wouw said. "That's the shipping business."

He pointed out that under normal circumstances, air freight is a business that requires a lot of expertise and advantages of scale to become a viable and profitable business, because the profit margins of air freight business are actually very low.

“Running an all-cargo airline has proven to be a fringe business from a profit point of view,” van de Wouw said of the years leading up to the pandemic.

“Furthermore, sea and air freight have little in common, so experience with the former does not guarantee success with the latter.”

"The similarity between air freight and ocean freight is that it's about moving boxes from A to B, however, that's where the similarities end," he said.

different strategies

The analyst highlighted that the three container lines have taken very different approaches to entering airfreight.

Maersk Group's overall strategy to transform into an integrated logistics service provider follows the acquisition of Hamburg-based air freight forwarder Senator International, which has operated Maersk-owned Star Air since 1987.

CMA CGM Group subsequently also included logistics as part of its strategic joint venture by merging Ceva logistics, the logistics arm of the company. In 2021, CMA CGM established an air cargo company, CMA CGM air Cargo, and plans to transform it into an independent air cargo company.

However, CMA CGM air Cargo soon became a joint venture with Air France-KLM, which meant that the French-Dutch company actually operated CMA CGM air Cargo.

MSC's MSC air cargo has put one aircraft into operation at present, and the company has completed the charging recently, and three more aircraft will join the company's fleet next year. MSC Air Cargo's aircraft are assisted by Atlas Air.

“These three companies are very different, and they do very different things from a scale perspective,” van de Wouw said.

He reckons Maersk and CMA CGM have similar strategies, noting that scaling is critical to their viability.

“In the case of Maersk, it’s a strategic decision that makes a difference, they do have a freight forwarding division and they have more airline experience, including through Senator,” van de Wouw said.

However, he also expressed concern that running a logistics business and an airfreight business under the same roof could also cause problems as the activities are fundamentally different.

He predicts that while logistics can be run with few assets, airfreight is asset-heavy, which could spell trouble for CMA CGM: “Asset-light companies and asset-heavy companies need very different mindsets, and when market prices fall, There will be conflicts of interest between airlines and freight forwarders who may be able to obtain better rates from third-party airlines.”